البحـث الأول

مجلة النفط والتعاون العربي

161

العدد

- 2017

أربعون

المجلد الثالث و ال

2016

أوابك العلمية لعام

�

ص لبحوث العلمية الفائزة بجائزة

�

عدد خا

77

67

much lower than Freedonia’s especially for 2014 even if marine oils are included.

In another report

64

, Fuchs Petrolub forecast 2017 demand at 41.3 million tons a

year, ag

ain much lower than Freedonia’s.

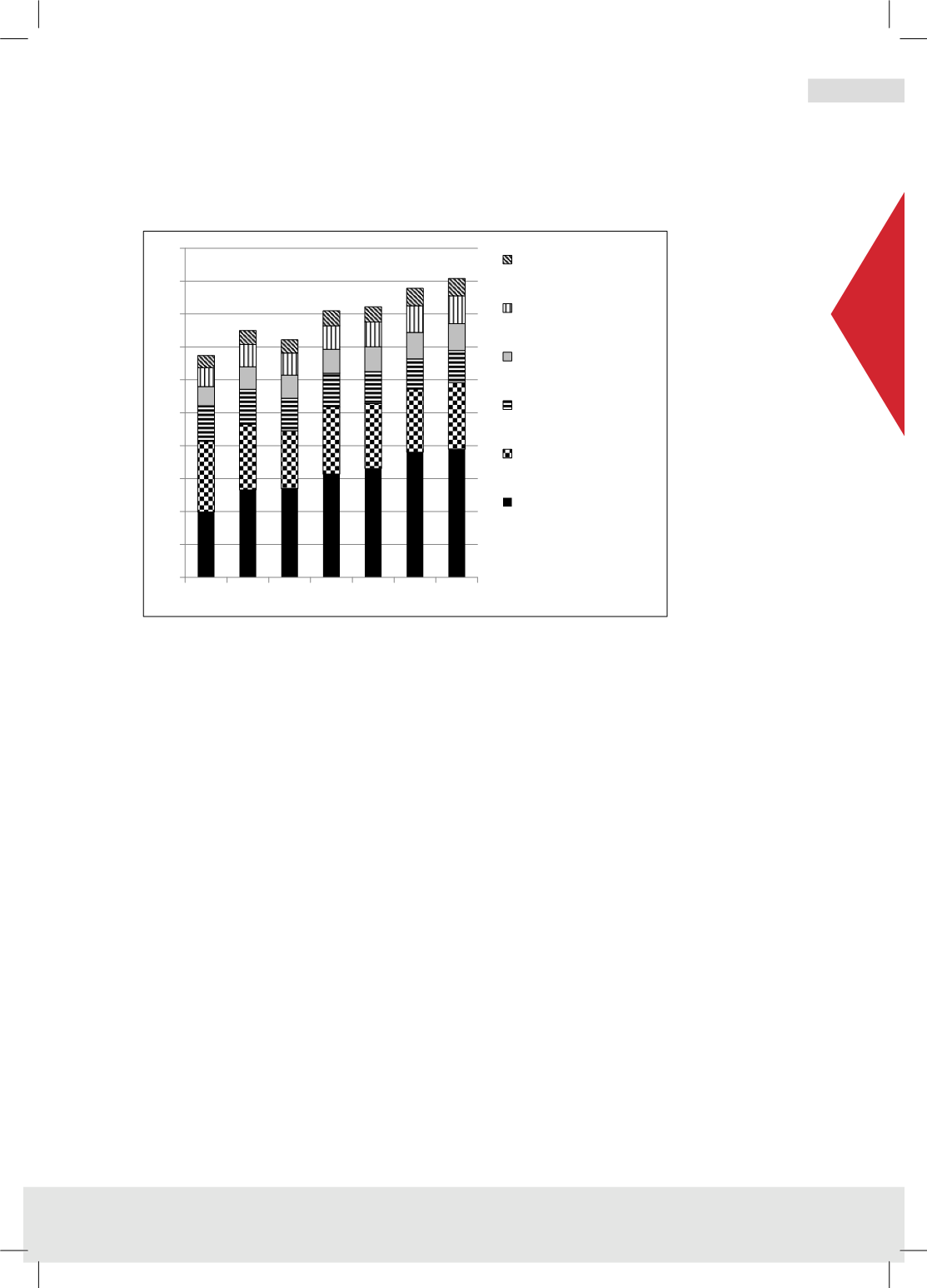

Fig (21) - Sources: 72, 73 & 74

In 2007

75

, the Freedonia’s forecasts were higher but the economic and financial

crises of 2008 reduced expectations as evident by the declining demand numbers

of 2009. Consumption then was expected to reach 46.6 million tons a year in

2015

75

, a number that is unlikely to be reached in the period under discussion.

It is to be understood that additives are capturing increasing share of the lubricants

market as their rate of growth surpasses that of base oils

71

. The new performance

standards and the extended oil drain periods require better lubricant’s packages

and therefore higher groups and more additives.

According to Kline & Co.

71

, the additives market in 2014 was 4.2 million tons of

39.4 million tons of finished oils, or 11%. The same report suggests that additives

demand is expected to grow at 1.6% while base oils demand growth may only be

at 1.2%. This will exacerbate a base oil industry likely to suffer from excess

capacity.

Base oils capacity surplus was 6.5 million tons a year in 2000

64

but the surplus

disappeared in later years, due to capacity rationalization, only to start appearing

again recently.

0

5

10

15

20

25

30

35

40

45

50

2002 2007 2009 2012 2014 2017 2019

Central & South

America

Africa/Middle East

Eastern Europe

Western Europe

North America

Asia-Pacific