Petroleum Devolopments

Volume 41 Issue 10

32

3.Oil Trade

USA

In July 2015, US crude oil imports increased by 513 thousand b/d or

7.3% comparing with the previous month level to reach 7.5 million b/d,

whereas US oil products imports decreased by 103 thousand b/d or 4.6% to

reach about 2.1 million b/d.

On the export side, US crude oil exports increased by 66 thousand b/d or

13% comparing with the previous month level to reach about 572 thousand

b/d, and US products exports increased by 230 thousand b/d or 6.5% to

reach 3.8 million b/d. As a result, US net oil imports in July 2015 were 114

thousand b/d or nearly 2.2% higher than the previous month, averaging 5.3

million b/d.

Canada remained the main supplier of crude oil to the US with 41% of

total US crude oil imports during the month, followed by Saudi Arabia with

13% ,then Mexico with 11%. OPEC Member Countries supplied 37% of

total US crude oil imports.

Japan

In July 2015, Japan’s crude oil imports increased by 500 thousand

b/d or 17% comparing with the previous month to reach 3.4 million b/d,

and Japan oil product imports also increased by 44 thousand b/d or 8%

comparing with the previous month to reach 601 thousand b/d.

On the export side, Japan’s oil products exports decreased in July 2015,

by 2 thousand b/d or 0.4% comparing with the previous month, averaging

515 thousand b/d. As a result, Japan’s net oil imports in July 2015 increased

by 543 thousand b/d or 18.3% to reach 3.5 million b/d.

Saudi Arabia was the big supplier of crude oil to Japan with 33% of

total Japan crude oil imports, followed by UAE with 31% and Russia with

7% of total Japan crude oil imports.

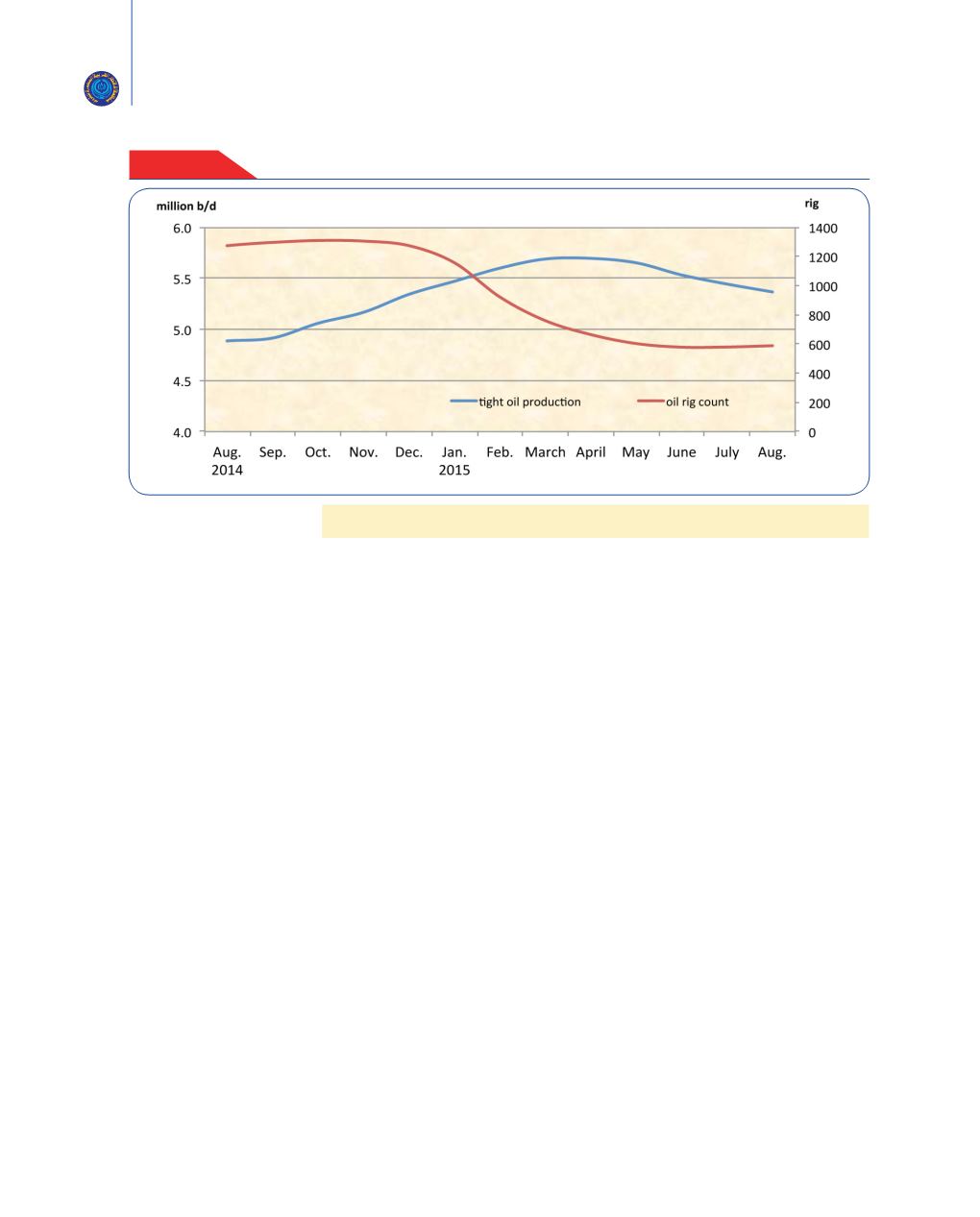

Figure - 7

US tight oil production and oil rig comt

(Million b/d)