Petroleum Devolopments

Volume 41 Issue 10

35

Aug.

2015 Sept.

Oct.

Nov.

Dec.

Jan.

2015 Feb.

Mar.

Apr.

May June July Aug.

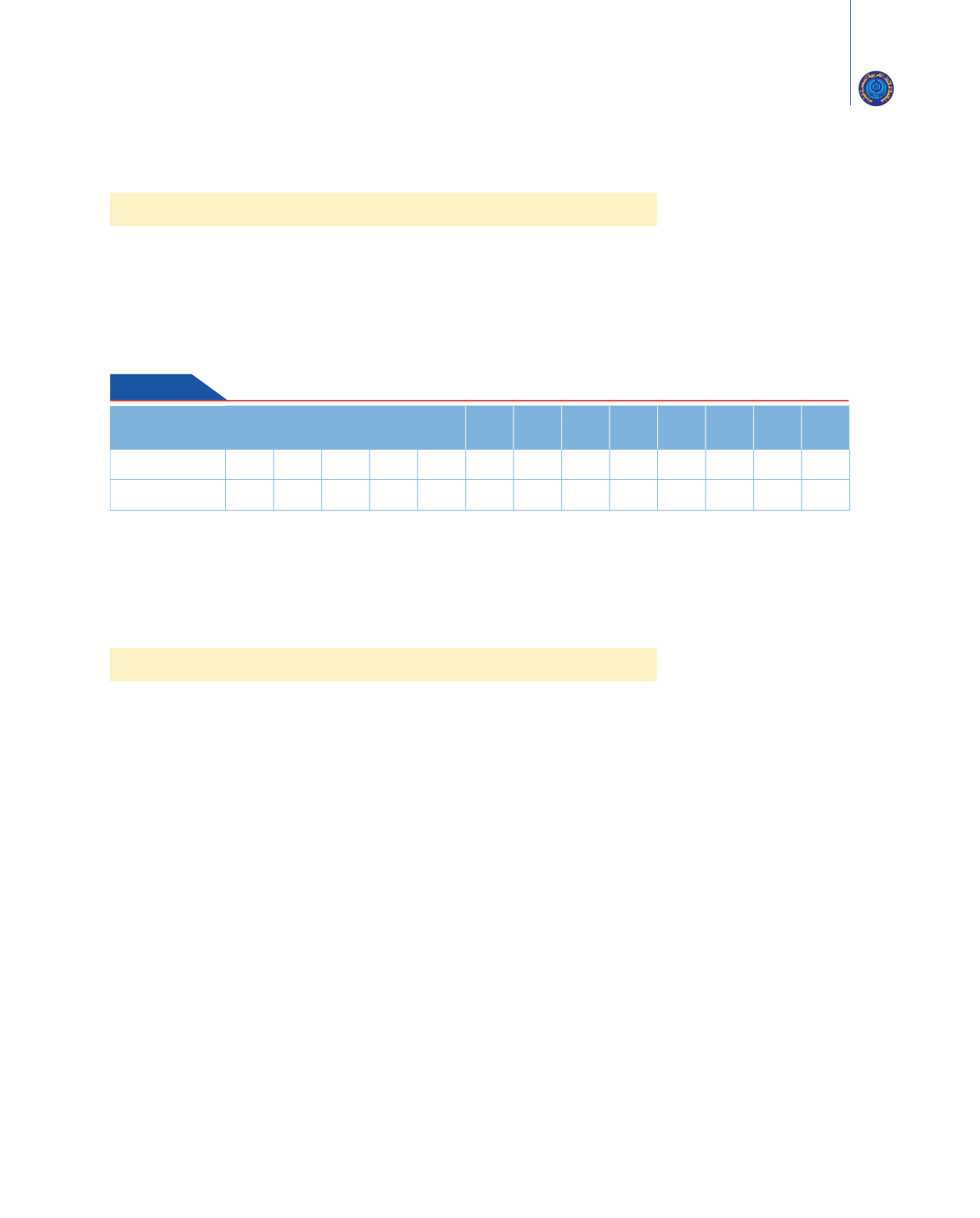

Natural Gas

(2)

3.9 3.9 3.9 4.1 3.2 3.0 2.8 2.8 2.6 2.8 2.8 2.9 2.6

WTI Crude

(3)

16.6 16.1 14.6 13.1 10.3 8.2 8.8 8.2 9.4 10.2 10.3 8.8 7.4

1. British Thermal Unit.

2. Henry Hub spot price.

3. WTI – West Texas Intermediate Crude oil price, in dollars per barrel, is converted to dollar per million BTU using a conversion factor

of 5.80 million BTU/bbl.

Source: World Gas Intelligence September 2, 2015.

Table 5

Henry Hub Natural Gas, WTI Crude Average, and Low Sulfur Fuel Oil Spot Prices, 2014-2015

( Million BTU

1

)

II. The Natural Gas Market

1- Spot and Future Prices of Natural Gas in US market

The monthly average of spot natural gas price at the Henry Hub in

August 2015 decreased by $0.25/million BTU comparing with the previous

month to reach $2.63/ million BTU.

The comparison, shown in

table (5)

, between natural gas prices and the

WTI crude reveal differential of $4.8/ million BTU in favor of WTI crude.

2- LNG Markets in North East Asia

The following paragraphs review the developments in LNG Markets

in North East Asia, concerning prices and Japanese, Chinese and South

Korean imports of LNG and their sources, and LNG Exporters Netbacks.

2.1. LNG Prices

In July 2015, the price of Japanese LNG imports increased by $0.3/

million BTU comparing with the previous month to reach $8.9/ million

BTU, whereas the price of Korean LNG imports decreased by $0.3/

million BTU comparing with the previous month to reach $8.8/ million

BTU, and the price of Chinese LNG imports decreased by $2/million

BTU comparing with the previous month to reach $7.5/ million BTU.

2.2. LNG Imports

Total Japanese, Korean and Chinese LNG imports from various

sources, increased by 10% or 1.012 million tons from the previous

month level to reach 11.146 million tons.

Table (6)

shows the prices and quantities of LNG imported by Japan,

South Korea, and China for the period 2013-2015.