180

2016

أوابك العلمية لعام

�

ص لبحوث العلمية الفائزة بجائزة

�

عدد خا

مجلة النفط والتعاون العربي

161

العدد

- 2017

أربعون

المجلد الثالث و ال

Re-refining of Used Lubricating Oil and its Economic and Environmental Implications

57

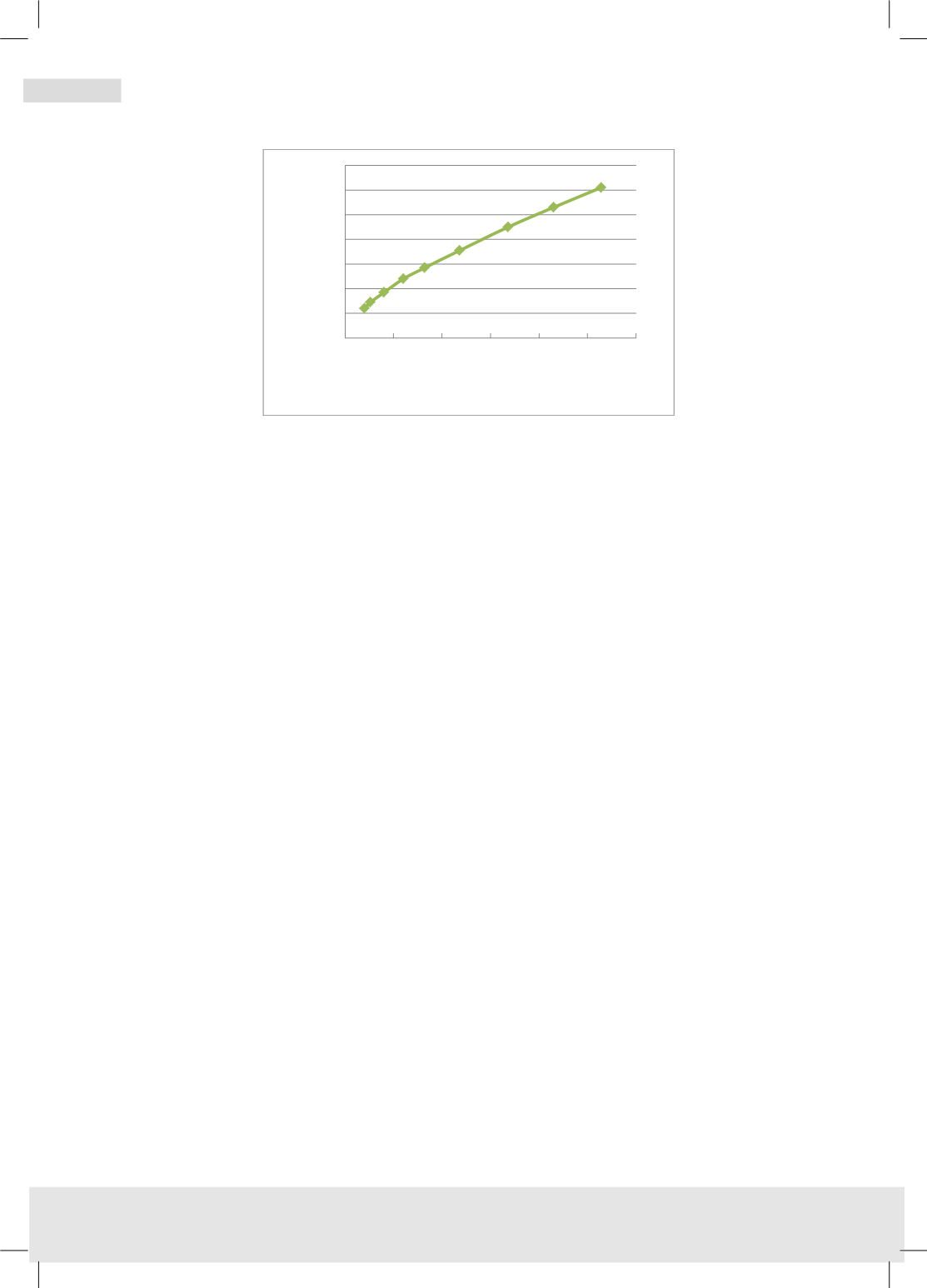

Figure 31 Capital costs versus capacity for a grassroots re-refinery

Source: Reproduced from (Park, 2012)

7.1.4 Profitability

In order to compete, the re-refined lube oil must be sold at a lower price than virgin oil

base stocks. Actually, re-refined base oils have always been linked to virgin base stocks

depending themselves on the price of crude oil. Historical re-refining margins were in

the range of $1.0 per gallon and $2.5 per gallon during the 2010-2014 period. Up till

now, this spread has provided re-refiners with substantial revenues. But this boom

period may be over as the industry's specific cycle is declining and falling oil prices are

starting to have an effect on the re-refining industry. Kline´s November 2015 report

(Globenewswire, 2015) showed a steady decline in re-refinery margins and Kline went

on to predict that prospects for a short term rebound in re-refinery cash margins are

limited.

The re-refining industry is constrained both by feedstock cost and product prices which

are dictated by oil product prices. While a high feedstock cost will put pressure on

profits margin, a low base oil selling price will make it difficult to maintain these

profits. The re-refiner has no control over the base oil market, and is usually forced to

accept the market price if he wants to sell its products.

0

20

40

60

80

100

120

140

0 50000 100000 150000 200000 250000 300000

Capital cost(MUS$)

Capacity (Tons/yr)