مجلة النفط والتعاون العربي

161

العدد

- 2017

أربعون

المجلد الثالث و ال

2016

أوابك العلمية لعام

�

ص لبحوث العلمية الفائزة بجائزة

�

عدد خا

90

80

For a smaller plant of 30 thousand cubic meters a year, the situation is much

worse as the IRR is 2% and NPV is negative at $16.037 million. To break even,

used oil cost has to fall to $7.95 a barrel which makes the case for subsidy even

more apparent.

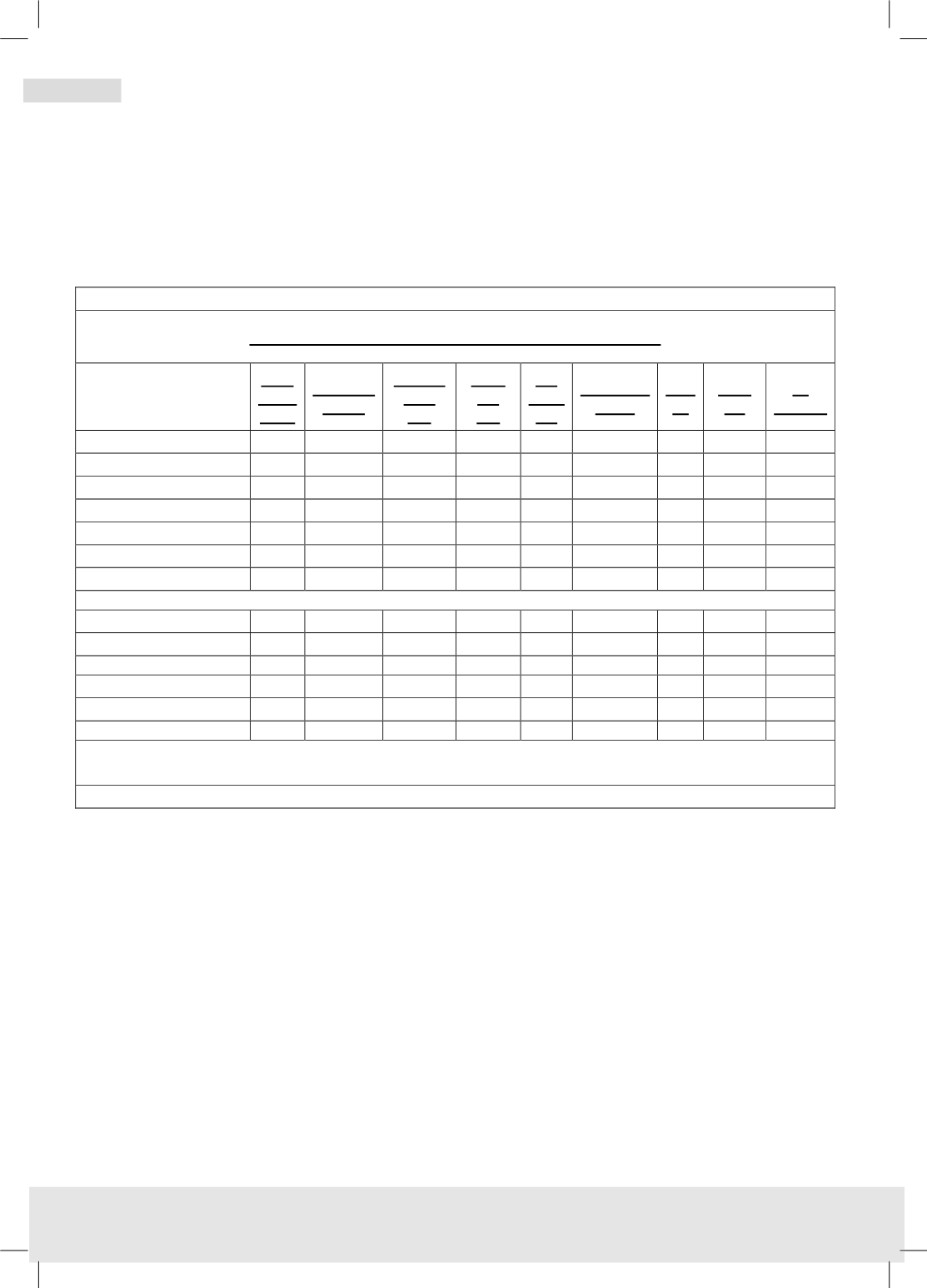

Table (20)

Large Plant (Hydro-treating) Sensitivity Analysis - 10 years

Base

Stock

$/ton

Capacity

ML/Y

Capital

Cost

M$

Used

Oil

$/L

Oil

Price

$/b

Hydrogen

$/CM

IRR

%

NPV

K$

%

Change

Base Case

700

50

45

0.27

98

0.5

20

8602

Base Stock Change

648

15

0

-7

Capacity Change

44.7

15

0

-11

Capital Cost Change

51.5

15

0

14

Used Oil Change

0.3

15

0

11

Oil Price Change

76

15

0

-22

Hydrogen Change

63.4

15

0

12584

Current Example 1

600

50

50

0.15

40

0.5

12

-4922

Current Example 1 S

600

50

50

0.13

40

0.5

15

0

Current Example 2

600

30

36

0.15

40

0.5

2

-16037

Current Example 2 S

600

30

36

0.05

40

0.5

15

0

M= million L= litre b= barrel CM= cubic metre IRR= internal rate of returns

NPV= net positive value k= 1000 Used oil cost = $23.85/b including transportation.

Source: Author Development

In this report, the model in its original format, with the exception of the small

modifications mentioned earlier, has been used in this analysis. However future

users may improve the model by segregating and reporting expenditures prior to

the start of production instea

d of including all these as “capital” in year 1. This is

likely to give better and more encouraging economic results. At the same time

the analysis may be extended to 15 or 20 years and this also will give better

economic returns.

Notes for Economic Consideration: