مجلة النفط والتعاون العربي

161

العدد

- 2017

أربعون

المجلد الثالث و ال

2016

أوابك العلمية لعام

�

ص لبحوث العلمية الفائزة بجائزة

�

عدد خا

88

78

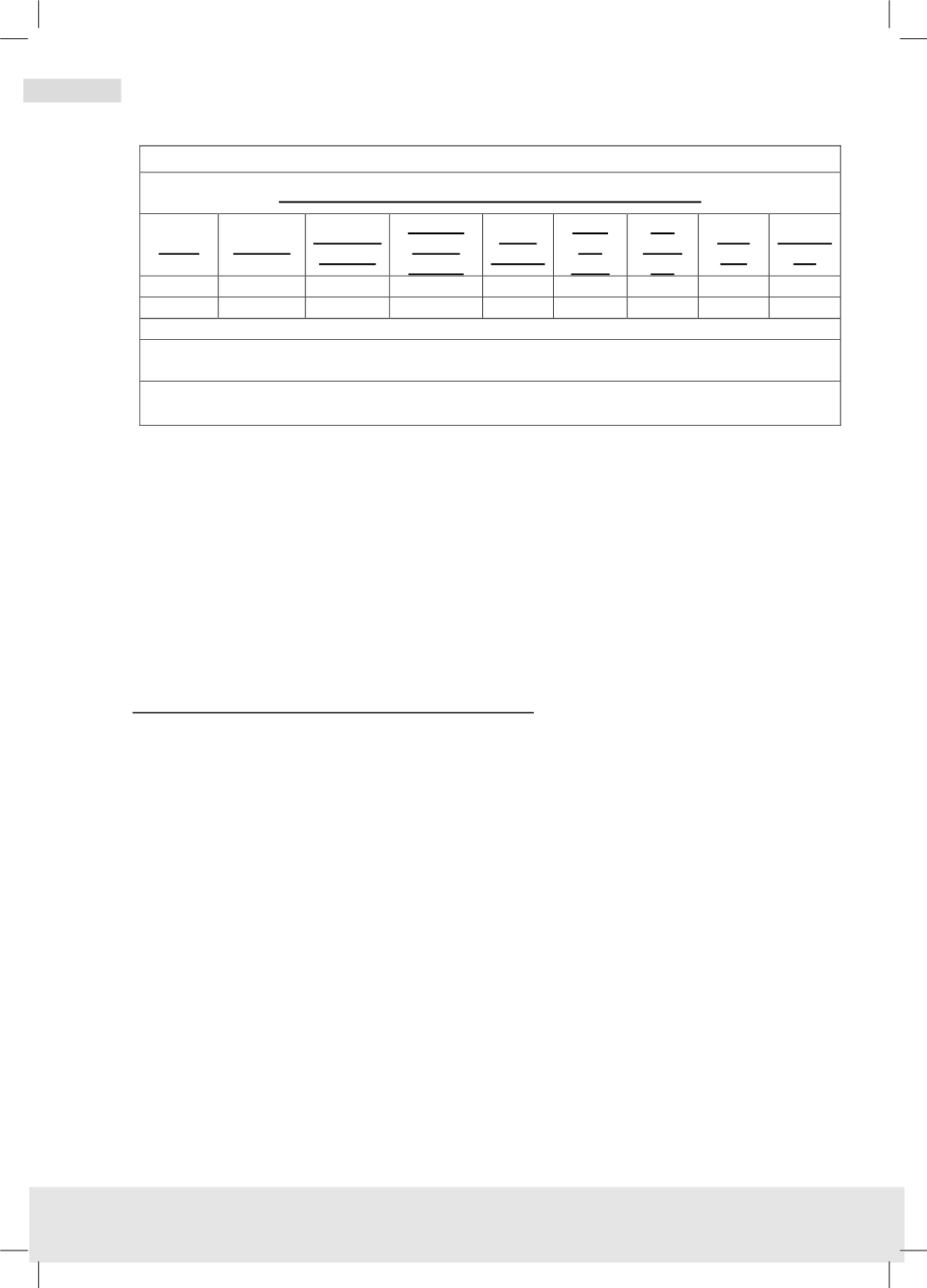

Table (18)

Base Case Major Parameters of Two Re-refining Plants

Plant

Process Capacity

Mil L/y

Capital

Cost $

Million

Used

Oil $/L

Base

Oil

$/ton

Oil

Price

$/b

IRR

%*

NPV**

K$

Small

Clay

20

6

0.27

700

98

27

3172

Large

Hydrogen

50

45

0.27

610

85

32

117377

* Internal rate of returns on Investment ** Net Positive Value of cash flow (15% discounted)

L= liter

Source: 1 &

https://www.crcpress.com/Refining-Used-Lubricating-Oils/Speight-Exall/9781466551497

However, the model as it is needs some adjustments to separate the impact of

base oil prices from those of crude oil prices but it remains a useful tool for initial

analysis and could be adjusted further to suit the situation at hand. Many scenarios

can be run for the same process or for different processes to make meaningful

comparison for decision making.

There are major parameters that affect the economics of re-refining projects but

some have bigger impact than others, which necessitate a sensitivity analysis to

set the priorities of caring for these parameters.

Distillation/Clay Treatment Plant Economics:

The discount rate that makes the net positive value equals to zero is the internal

rate of return that makes the project over the considered period breaks even.

Obviously the investors want a higher rate of return and a higher number for the

net positive value. In fact some investors not only seek a higher internal rate of

return but also target a value for the net cash flow.

In the case of the small plant of distillation and clay treatment the economics is

most sensitive to the price of base stock. Only a 6% decline of base oil prices

sends the cash flow to zero while 11% increase of used oil cost is the second

parameter with respect to sensitivity. Other parameters (capacity and capital cost)

are not as sensitive. The results are shown in Table (19). In the same table current

conditions are used to generate economics for 20 and 30 thousand cubic meter

plants. Base stock price is current (April 2016) and capital cost adjusted by 10%

for the Middle East location. Used oil cost is $23 a barrel as discussed in the next

chapter.