البحـث الأول

مجلة النفط والتعاون العربي

161

العدد

- 2017

أربعون

المجلد الثالث و ال

2016

أوابك العلمية لعام

�

ص لبحوث العلمية الفائزة بجائزة

�

عدد خا

89

79

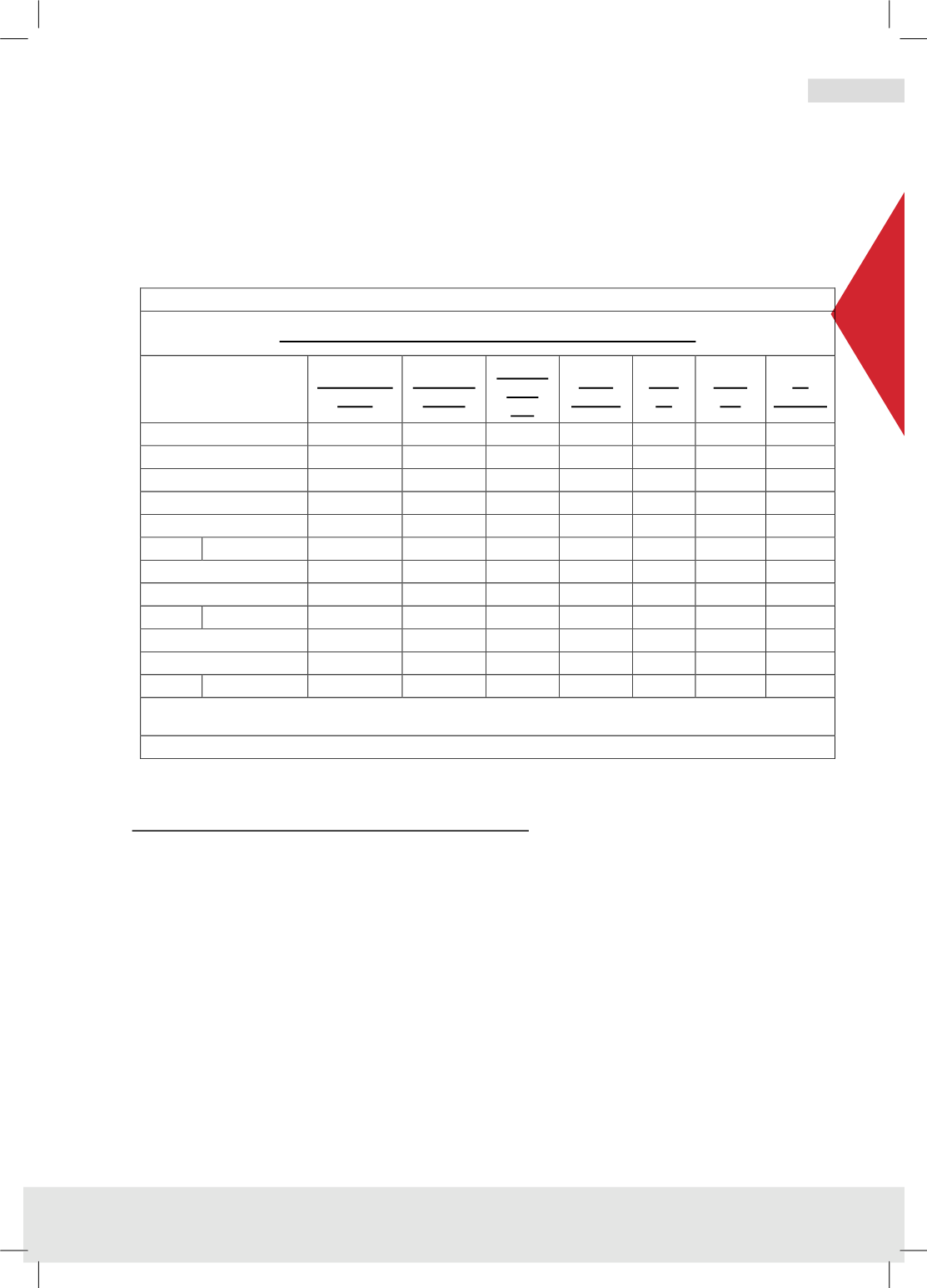

The internal rate of return is 19% and net positive value is $1.103 million. Used

oil cost can increase to $24.5 a barrel before NPV falls to zero. For a larger plant,

the IRR is 23% and NPV $3.853 million and an increase of used oil cost to $27 a

barrel would make NPV equals zero. In such a case subsidies would be in order

to encourage investment.

Table (19)

Small Plant (Clay Treatment) Sensitivity Analysis - 10 years

Base Stock

$/ton

Capacity

ML/Y

Capital

Cost

M$

Used

Oil $/L

IRR

%

NPV

K$

%

Change

Base Case

700

20

6

0.27

27

3172

Base Stock Change

656

15

0

-6

Capacity Change

15

15

0

-23

Capital Cost Change

8

15

0

38

Used Oil Change

0.3

15

0

11

Current Example 1

500

20

6.6

0.15

19

1103

Current Example 1 S

500

20

6.6

0.16

15

0

Current Example 2

500

30

8.6

0.15

23

3853

Current Example 2 S

500

30

8.6

0.17

15

0

M= million L= litre IRR= internal rate of return NPV= net positive value

Used oil cost $23.85/b including transportation.

Source: Author Development

Distillation/Hydrogenation Plant Economics:

The parameters in this case are more numerous as can be seen in Table (20). In a

similar manner as said above, the economics are sensitive to base oil price,

capacity, used oil cost and capital investment in that order. The plant is not

sensitive to hydrogen cost due to the relatively small quantity required.

Applying the model for a 50 thousand cubic meters a year plant and to current

values, the IRR is found to be 12% but the NPV is negative at minus $4.922

million. For the plant to break even the cost of used oil has to fall to close to $20.7

a barrel and to make reasonable profit used oil cost has to fall further or subsidies

by government would be necessary to encourage investment.